1.01(A) This supplement contains the Michigan Child Support Formula’s most current economic data and supporting materials. The supplement’s purpose is to update information without republishing the entire manual.

1.01(B) When using the Michigan Child Support Formula to calculate support, you need to use the most current supplement in effect.

1.01(C) To verify whether you have the most current materials, or to find additional information helpful in using the formula, please check the Michigan Child Support Formula’s official website at https://courts.michigan.gov/mcsf.

1.02(A) References to material contained in this supplement should contain the year it became effective, as well as the specific provision referenced. The supplement may be abbreviated as “MCSF-S.” This section should be cited as 2021 MCSF-S 1.02.

2.01(A) The Low Income Threshold is $1,063.00 (2020 United States HHS Poverty Guideline).

2.02 Ordinary Medical Expense Amounts

2.02(A) On average, families spend $454 for one child annually on ordinary medical expenses. The Ordinary Medical Expense Averages table states the amounts families are presumed to spend on ordinary medical expenses. Courts may add amounts to cover higher expenses. (2021 MCSF 3.04(B)).

Ordinary Medical Expense Averages | ||

|---|---|---|

Children | Annual | Monthly |

1 | $454.00 | $37.83 |

2 | $908.00 | $75.67 |

3 | $1,362.00 | $113.50 |

4 | $1,816.00 | $151.33 |

5 or more | $2,269.00 | $189.08 |

2.03 General Care Support Tables

2.03(A) Based on the estimated costs of raising children, the General Care Equation (2021 MCSF 3.02(B)) uses variable percentages of family income to determine a child support obligation. The General Care Support Tables contain those figures and percentages exclude medical and child care expenses. This supplement contains net family income levels adjusted using the February 2020 Consumer Price Index (CPI-U Detroit) from its 1985 original base.

2.03(B) Normally, when a family’s net monthly income exceeds the highest income level in General Care Support Tables, support will be determined using listed figures for the correct number of children. However when a family’s income greatly exceeds the highest income level, the court may exercise discretion as permitted by 2021 MCSF 3.02(E).

2.03(C) Tables

Chapter 3. Explanatory Materials

3.01 Substantial Changes in Circumstance Reviews

3.01(A) When a friend of the court office is not obligated to initiate a review under MCL 552.517(1), it must conduct one pursuant to MCL 552.517b(9) when a party presents evidence, such as a document or other written corroboration about the circumstance, as described in MCSF-S 3.01(B) to the office that a substantial change in circumstances has occurred after the last support order was entered. While similar to changed circumstances that a court could consider when deciding whether to grant a motion, the factors cited in this section only apply to determining when the office must conduct a support review beyond those required by MCL 552.517(1).

3.01(B) A substantial change in circumstances to warrant a review of the support amount occurs when any of the following situations arise:

(1) The payer begins or stops receiving social security benefits.

(2) A child receives social security benefits based on the support payer’s earnings record, or a reduction occurs in those benefits by $50 per month or more.

(3) A health issue affects a party’s ability to earn income for a substantial period (a permanent or long-term disability or injury, a lengthy hospital stay and recuperation, etc.).

(4) A parent’s income changes by 75 percent or more.

(5) A parent receives a call to active military duty likely to last at least six months and result in a significant income reduction.

(6) Significant changes in the medical expenses of a party.

(7) Changes in the physical, mental, or educational needs of a child.

(8) A significant change in financial circumstances because of a modification of the payer’s other support obligations.

(9) The office learns that a payer is incapacitated, unless the office can document sufficient assets or a source of income that could be used to comply with the order. 2021 MCSF 4.02.

3.02 Determining Which Parent Should Maintain Health Care Coverage

3.02(A) MCL 552.605a contains the statutory requirements regarding provision of health care coverage. The federal Affordable Care Act also contains requirements for parents to maintain coverage for dependent children.

(1) Support orders must specify which parent should maintain coverage. To prevent purchasing duplicate coverage, extra costs, and unnecessary enforcement actions, do not automatically order both parties to provide coverage.

(2) Coverage means health care insurance available to cover a child, whether private coverage provided as a benefit of employment, purchased, or through alternative means (a parent’s spouse or household member), or public coverage like SCHIP (MIChild) or Medicaid.

(3) The court may allow a parent’s obligation to provide coverage to be met through alternative means (e.g., insurance is available for a child through a parent's spouse or other household member). A parent should be required to secure health care coverage immediately if alternative coverage for the children stops. For example, an order could state:

The (defendant/plaintiff) shall maintain health care coverage for the child(ren). At the option of the (defendant/plaintiff), coverage can be obtained by purchasing it or by enrolling the child(ren) in coverage available through a household member.

(4) MCL 552.605a requires the presumptive use of the definition of the reasonable cost of coverage and accessible coverage. It also permits the court to exercise its discretion when ordering health care coverage based on the child’s needs and the parents’ resources.

3.02(B) Consider the following when determining which parent must maintain the children’s health care coverage:

[Private coverage includes coverage available through alternative means]

(1) Do the parents agree who should maintain the children’s coverage?

(a) If yes, and provided that coverage is not public coverage, select that parent or both parents as agreed, to maintain coverage. A detailed review is unnecessary.

(b) If no, proceed to (2).

(2) Does either parent have private coverage available that is accessible to the child?

(a) If one, proceed to (3).

(b) If both, proceed to (4).

(c) If neither, proceed to (5).

(3) Only one parent has accessible private coverage available. Is the parent’s net cost of coverage at or below the reasonable cost of coverage?

(a) If yes, select that parent to maintain coverage.

(b) If no, proceed to (5).

(4) Both parents have accessible private coverage available, and do not agree on who should maintain coverage. Compare the plans using the following questions.

(a) Does either parent’s net cost of coverage exceed the reasonable cost of coverage?

(i) If no, proceed to (b).

(ii) If one plan is available at a reasonable cost, select that parent to maintain coverage.

(iii) If neither plan is available at a reasonable cost, proceed to (5).

(b) Is one parent more likely to maintain coverage or one plan’s coverage less likely to lapse?

(i) If yes, select that parent to maintain coverage.

(ii) If no, proceed to (c).

(c) Does one plan have lower out-of-pocket costs for the child’s expenses (e.g., lower deductibles, co-payments, benefits for a child’s specific conditions, child’s providers in plan’s network, etc.) or have significantly lower net costs to insure the children (2021 MCSF 3.05(C)(2))?

(i) If yes, select that parent to maintain coverage.

(ii) If no, proceed to (d).

(d) Does one parent’s plan offer services that are easier to access or closer to where the child resides or would usually receive care?

(i) If yes, select that parent to maintain coverage.

(ii) If no, proceed to (e).

(e) When there are not significant differences between plans in coverage or affordability, select the parent who will claim the minor children as dependents on his or her federal tax return this year.

(5) If neither parent has coverage that is both accessible and available at a reasonable cost, is there private coverage available at a reasonable cost to either parent?

(a) If yes, the court has discretion to select that parent to maintain coverage.

(b) Otherwise, select a parent who is eligible to enroll the children on public coverage like Medicaid, SCHIP, or other similar program.

3.03 Adjusting Support Payments for Parenting Time

3.03(A) The economics in the General Care Equation base support calculation only consider the expense of a child living in one household. Because children often spend time in two households, the parent caring for a child should directly incur more child-related costs, which should reduce expenditures in the other parent’s home.

3.03(B) Time away from a parent’s home will reduce some costs, but not all child-related expenses. Households may have duplicated expenses for a child, like the residual cost to maintain a place for a child to return. The costs in the child’s primary home remain largely unaffected, when a child inconsistently spends or does not spend much time with one parent.

3.03(C) Michigan’s Parental Time Offset equation considers the obligations that each parent owes for a child, and balances some of the duplicated costs with the savings caused by time spent in the other parent’s household. In the following situations, the equation should produce these results:

(1) When a child spends equal time with both parents with equal incomes, neither parent pays the other.

(2) When a child spends equal time with both parents, the parent with a higher income pays some support.

(3) No reduction occurs when the child does not spend any time with a parent.

(4) Small reductions reflect some unduplicated costs. Reduced offsets continue until a parent will likely incur enough child-related expenses that make it unfair not to adjust support.

(5) An increasingly greater reduction occurs in the amount a parent owes to the other as a child spends more time in the parent’s household.

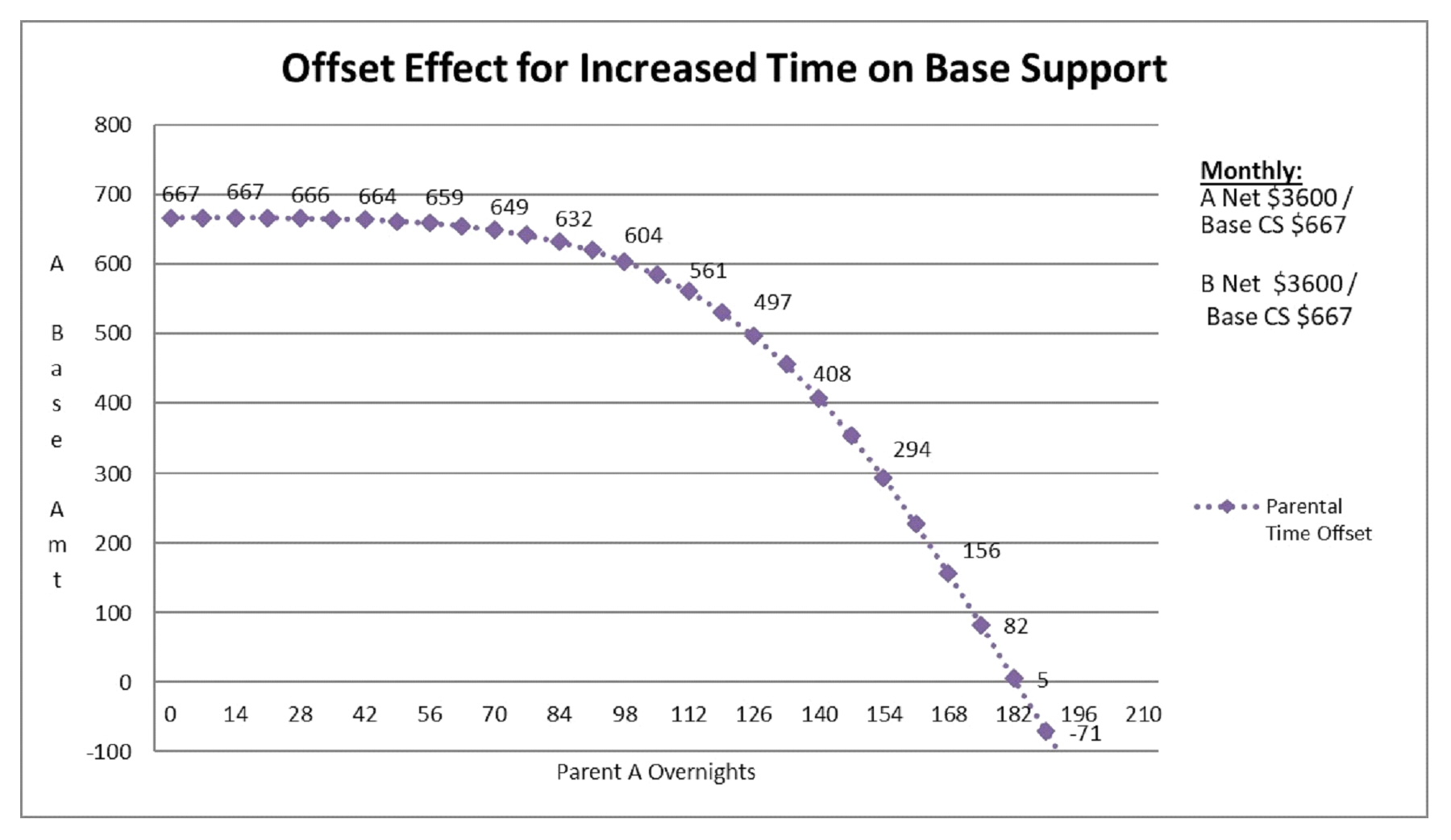

3.03(D) The following graph demonstrates the balancing effects the Parental Time Offset has on a parent’s base support obligation as the child spends more time with one parent.

3.04 Adjusting Incapacitated Parents’ Obligations

3.04(A) Temporary orders may set an appropriate payment amount based on the present ability to pay, and adjust the charges when a future outcome is known. 2021 MCSF 4.02.

3.04(B) Because incapacitation indicates that a parent’s ability to pay has substantially changed to the extent that the support order may need modification, the friend of the court office should quickly initiate a review of the child support obligations pursuant to MCL552.517(1)(f). The FOC office may initiate a review when the incapacitation could last less than 180 days or when the length of incapacitation is difficult to determine.

(1) The office is not required to conduct a review when:

(a) An incapacitated payer’s support order is set at zero,

(b) The payer has documented assets or a source of income that could be used to comply with the order, or

(c) The support order contains prospective language that abates support for periods when a payer is incapacitated.

(2) In addition to reviewing an order when a parent becomes incapacitated, the friend of the court office should conduct a review when the parent’s financial circumstances change (e.g., social security, insurance, settlements, proceeds from lawsuits, returns to work, etc.), or when a payer is released from incarceration.

3.04(C) A time when a payer is incarcerated does not depend on being sentenced to 180 days confinement or more. When a payer is arrested and held without bail in county jail, it is hard to know whether the payer will be released by posting bail, convicted and sentenced to many years in prison, or acquitted. Consider a parent to be incapacitated if the circumstances appear likely that the payer will be unable to earn an income for a period that will likely last 180 days or longer and due to incarceration.

3.04(D) It is often difficult to predict the time it will take a person to recover when the parent is involved in an accident and suffers a serious injury or broken bones. That parent may be unable to work for several months, or be permanently disabled. Consider a parent to be incapacitated if it appears likely that the condition will cause the parent to be unable to earn an income for a period that will likely last 180 days or longer due to disability, mental incompetency, serious injury, debilitating illness, etc.

3.04(E) To avoid retroactive modification and to reduce the need review and modify an order, the court may include prospective language that abates support when a support payer is incapacitated that is similar to the following.

When friend of the court becomes aware that payer’s condition that meets the definition of incapacitation as defined in the current or subsequent Michigan Child Support Formula, monthly support charges shall abate and are temporarily reduced to zero effective the date the friend of the court office provides notice of the abatement to the parties and to the court. Support charges shall be reinstated effective 60 days after the incapacitation ends. The office shall provide notice of reinstatement to the parties and to the court that specifies the date charges will be effective.

Either party may object to the abatement or reinstatement by filing a written objection with the court within 21 days following when the notice was filed, or by filing a motion. If a timely objection is received, the friend of the court shall either set the objection for hearing or complete a support review with an effective date no earlier than the date of filing of that notice.

Based on a motion by either party or a recommendation following a review by the friend of the court, the amount abated may be later corrected based on the parties’ incomes or ability to pay during the abatement period.

3.05 Crediting Government Insurance Program Dependent Benefits

3.05(A) A parent’s income includes dependent benefits from government insurance programs as provided in 2021 MCSF 2.01(I)-(K). Only the children’s dependent benefits paid to the support recipient based on the support payer’s earnings record that were counted as the payer’s income may be used to reduce the payer’s support obligation as outlined in 2021 MCSF 3.07. A payer may not receive credit for benefits paid for the children based on another person’s earnings record, or that are not counted as the payer’s income.

3.05(B) Dependent benefits paid for the care of additional children not in common with the other parent are not considered as a parent’s income.

3.05(C) Benefits Paid on a Support Payer’s Earnings Record.

(1) When calculating a support obligation, the payer’s income includes that parent’s disability or retirement benefits, as well as any dependent benefits paid for the children-in-common based on the payer’s earnings record.

(2) After the payer’s total support obligation is calculated, subtract the monthly benefit amount that the recipient receives for the children based on the payer’s earnings record. If the benefit exceeds the support obligation, no additional amount should be ordered paid as child support. If the obligation exceeds the dependent benefit, the payer should be ordered to pay the difference as child support.

(3) Support Payer’s Record Example. Based on his own earnings records, Parent A receives $1,850 each month Social Security benefits. Based on Parent A’s records, $1,100 in dependent benefits are paid for the two children-in-common with Parent B in the case being calculated.

Parent A’s income includes his benefit of $1,850 as well as $1,100 in dependent benefit paid on his behalf. The result of the total support calculation is that Parent A would pay $960 to Parent B.

(a) If Parent B, the support recipient, is the representative payee for the children’s benefits based Parent A’s earnings record, the $1,100 of children’s benefits are subtracted from $960 total support amount owed by the payer. Because the children’s benefits exceeds the calculated support amount, no additional amount is ordered.

(b) If Parent A, the support payer, is the representative payee for the children’s benefit based on his own earnings record, because the support recipient does not receive the payment, no benefits are deducted from the support obligation. Parent A should be ordered to pay $960 as child support to Parent B.

3.05(D) Benefits Paid on a Support Recipient’s Earnings Record.

(1) When calculating a support obligation, the support recipient’s income includes that parent’s disability or retirement benefits, as well as any dependent benefits paid for the children-in-common based on the recipient’s earnings record.

(2) After the support obligation is calculated, nothing is credited against the payer’s obligation because the children's benefits are not based on the payer's earnings record. The payer will owe the full amount calculated.

(3) Support Recipient’s Record Example. Based on his own earnings records, Parent A receives $1,420 each month Social Security benefits. Based on Parent A’s records, $900 in dependent benefits is paid for the child-in-common with Parent B in the case being calculated.

Parent A’s income includes his benefit of $1,420 as well as $900 in dependent benefit paid on his behalf. The result of the total support calculation is that Parent B would pay $546 to Parent A.

(a) If Parent A, the support recipient, is the representative payee for the children’s benefits based on his own earnings record, Parent B would be ordered to pay $546 because the child’s benefits are not based on Parent B's earnings record.

(b) If Parent B, the support payer, is the representative payee for the children’s benefits based Parent A’s earnings record, Parent B would be ordered to pay $546 because the child’s benefits are not based on the support payer’s earnings record.

(i) Despite the payer’s calculated obligation of $546 is substantially less than the $900 in benefits that payer receives for the children based on the recipient’s earnings record, Parent B cannot be ordered to pay additional support to try to return a greater amount of the benefit to the support recipient. Federal law clearly bars alienating a child’s benefits from the representative payee selected by the administering agency.

3.05(E) Benefits Paid on Both Parent’s Earnings Record.

(1) When children-in-common receive dependent benefits based on multiple adults’ earnings records, the amount is determined based on the adult’s record that results in the highest benefit for the children. Before amounts can be attributed to more than one person, a party must provide sufficient documentation to distinguish on whose behalf the benefits are paid. When both parents receive benefits from the same government insurance program (e.g., Social Security Administration) and the children receive dependent benefits based on a parent’s earnings record, 2021 MCSF 2.01(K) specifies how the dependent benefits are considered parent income.

(a) Include any portion of the children’s benefit that can be attributed to the payer’s earnings record as the payer’s income first.

(b) Any amount of the children’s dependent benefit based on the other parent’s earnings record that exceeds the amount attributed to the payer is included as the other parent’s income.

(c) After the payer’s total support obligation is calculated, subtract the monthly benefit amount that the recipient receives for the children based on the payer’s earnings record. If the benefit exceeds the support obligation, no additional amount should be ordered paid as child support. If the obligation exceeds the dependent benefit, the payer should be ordered to pay the difference as child support.

(2) Both Parents Record Example. Based on Parent A’s earnings records, she receives $1,930 each month in Social Security benefits. Based on Parent A’s records, $1,110 in dependent benefits are paid for the child-in-common with Parent B in the case being calculated. Parent B receives $1,986 each month in Social Security Benefits based on his own earnings record. Parent B has one additional child for whom he receives $568 in dependent benefits. Parent B provides documentation from the Social Security Administration that shows the child in this case would also be eligible to receive $568 in dependent benefits based on his work record. Because Parent B only exercises 90 overnights of parenting time and will owe health care premiums to Parent A, Parent B will be the support payer.

Parent A receives $1,110 monthly as the child’s dependent benefit. The amount of the dependent benefit that is attributed to Parent B is $568, and the remaining $542 is attributed to Parent A.

Parent A’s income includes her benefit of $1,930 as well as $542 in dependent benefits paid on her behalf. Parent B’s income includes his benefits of $1,986 and $586 paid for the child in this case. The additional child’s benefits are not counted as Parent B’s income. The result of the total support calculation is that Parent B would pay $638 to Parent A.

(a) Parent A is the representative payee for the children’s benefits. Because Parent B owes $638 in child support to Parent A, subtract $586 dependent benefit paid based on Parent B’s earnings record. Parent B should be ordered to pay the $52 difference.